Are your strategic insights insightful?

Strategic insights are a foundation of good strategy. But are yours insightful? Find out how to ensure they are.

Contents

Introduction

There are a number of frameworks you can use for generating, organising, summarising and processing strategic insights.

These include SWOT, PESTEL, McKinsey 7S and Porter's 5 Forces, etc.

But what matters more than these frameworks is the insights themselves.

Particularly, are they insightful?

Particularly, are they insightful?

If they're not, of course, then any use of such tools are frameworks is little more than an administrative exercise of box-ticking. This won't lead to any strategy breakthroughs.

I often see insights entered onto a SWOT, for example, as just one, or a few words. Perhaps for Strengths, someone will write "brand" or "people". For weaknesses, they might write "systems", or "funding". For opportunities, they might write "digital", and for Threats, they might write "war in Europe", for example.

Now, these may all be true, but are they insightful?

Checking for insight

To be insightful, you need to be able to answer two questions:

-

What exactly are you talking about?

-

So what?

So for "brand" it may be that you mean that the organisation has an unprompted brand awareness which is 12 points about the industry average. So what? Well, that may mean that you can charge a 20% premium for your services.

In that example, you want to write on your SWOT: "Having unprompted brand awareness which is 12 points above the industry average allows XYZ Corporation to charge a 20% premium for its service".

If you simply write "brand" on you SWOT, people will probably read it, nod and move on. However, if you write this more specific insight, people are much more likely to engage:

-

Do we agree with this statement?

-

How critical is this insight relative to the other (similarly specific) insights we have about this situation?

The discussion and debate could be fierce. It should be fierce. You're making a bold and unambiguous statement. It should be challenged, contemplated. It may need to be amended.

But once it has withstood this challenge and been finalised and accepted, you have an insight that can inform strategic thinking.

Your insights should be concise. That normally includes ensuring they are brief - but not so brief as to sacrifice meaning and impact. You can use supplementary notes to add further detail. In fact, if an insight is relevant and important enough to include in your strategic analysis, it probably deserves at least half a page of supporting evidence and analysis.

Your insights should be specific. In the case above, it is specific to the point of being quantified. That may not always be appropriate. For example, in the lead up to Brexit, a British financial services firm may have observed that "Brexit could mean that we are no longer able to passport financial products from other European countries into the UK." It may not be possible or necessary to quantify this. But it is still specific.

But don't not quantify something simply because you don't have the data. If you think unprompted brand awareness underpins an important strategic insight, but you don't have that data, then you should probably get it. Assumptions can be dangerous. Don't simple write brand on your SWOT because you're proud of and really like your brand, and then leave it at that. Collect the evidence. Validate your hypotheses.

Collect evidence and validate your hypotheses even for non-quantifiable strategic insights. For example, what is the legal basis for passporting financial products from other UK countries? How will Brexit affect this? What have the EU and the relevant regulators said on the subject? When do we think the situation is likely to be clarified? What resolutions are on the table?

As you do so, you may find that some strategic insights which seemed important and relevant start to seem less so. And vice versa. This is a natural process of evolution as you develop and explore strategic insights and your strategy begins to emerge.

Strategic analysis is a process of trying out and testing many candidate insights before winnowing them down to the just the handful of insights that most clearly articulate the strategic context in which you're operating.

Just because something is true, does not mean it is either insightful or relevant. Have the courage to set these aside until you're left with just the most insightful and relevant observations. Less is often more.

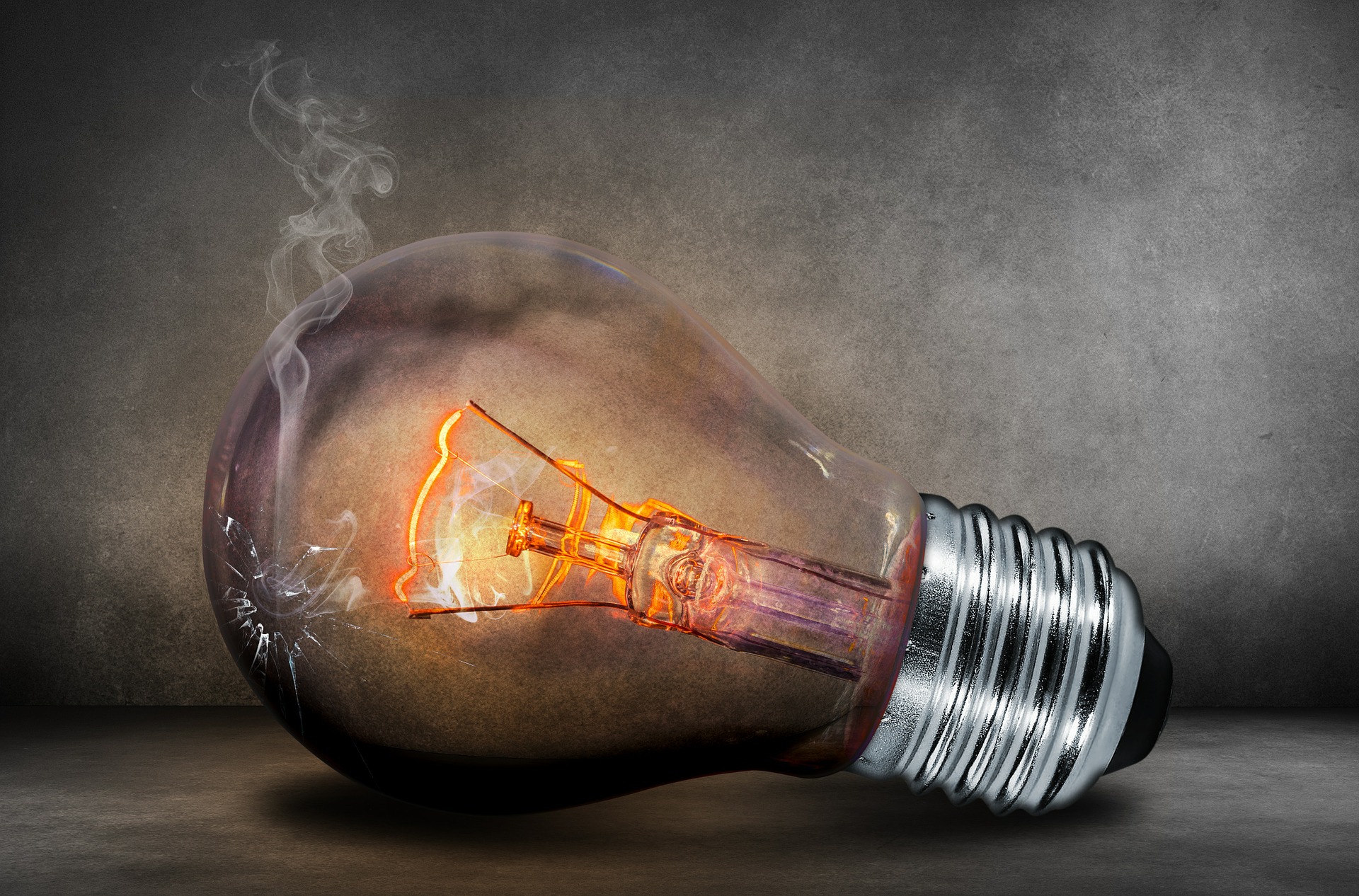

At the end of the process, you/your audience should be able to look at your SWOT, PESTEL, McKinsey 7S and/or Porter 5-Forces, and say "yes, I think we've gotten to the heart of the matter / the crux of the challenge here". There should be that a-ha light-bulb moment of clarity.

Writing more insightful insights

As a rule of thumb, strategic insights consist of three components:

-

Some observable phenomenon

-

has had / is having / could have / should have / (probably) will have

-

some impact (on the business / market).

Note also that the bridge (2) between the observable phenomenon and the impact conveys a sense of both time (past, present and/or future) and certainty (has, is or will imply certainty, whilst could or should imply degrees of uncertainty). Such words should be used carefully and with intention.

You can discern and underlying grammatical structure here:

|

Structure

|

Example 1

|

Example 2

|

|

1. Some observable phenomenon

|

Unprompted brand awareness which is 12 points above the industry average

|

Brexit

|

|

2. has had / is having / will have / should have / could have

|

allows

|

could mean that

|

|

3. some impact

|

XYZ Corporation to charge a 20% premium for its service

|

we are no longer able to passport financial products from other European countries into the UK.

|

You will see that these examples are not completely formulaic. Formulaic expressions of strategic insights tend towards being turgid. This clouds the thinking. Your strategic insights should read naturally and crisply. But you should still be able to identify these basic components.

Follow this approach, and watch your strategic analysis progress from an administrative process of filling out templates to an insightful process which drives strategic thinking and action.

Tips

- Replace adjectives and adverbs with data.

For example, change "Customers love X a lot" to "Customers with X spend on average 4x more than those without and we retain 80% of them year over year".

Avoid imprecise adverbs like "nearly", "significantly", etc. especially. - Pass the "so what" test.

The reader should immediately know why the insight is significant and relevant. - Keep your sentence structure simple.

Aim for simple subject verb object sentences in the active voice. - Strip out padding.

Say "because", rather than "owing to the fact that". Say "use" instead of "ulitise". Say "until" instead of "until such time as". "Say "to" rather than "in order to". - Avoid jargon and acronyms.

They exclude new people and even people from other departments/disciplines.

See also: