What is the BCG Matrix?

The BCG matrix is named after the Boston Consulting Group. It is a strategy analysis tool which helps to understand the strategic options available across a portfolio of different:

- business units,

- products,

- services,

- customer segments or

- channels.

The model shows that not all parts of a portfolio business are strategically equal. In so doing, it helps to facilitate more nuanced strategic analysis.

The model shows that not all parts of a portfolio business are strategically equal. In so doing, it helps to facilitate more nuanced strategic analysis.

How does the BCG Matrix work?

In its simplest form, the BCG matrix charts each source of value by:

- its share of its market and

- the rate at which that market is growing.

Sources of value could be business units, products, services, customer segments or channels. That is, you would choose one of these criteria, say product, and then chart all of the organisation's products relative to each other.

The 4 quadrants

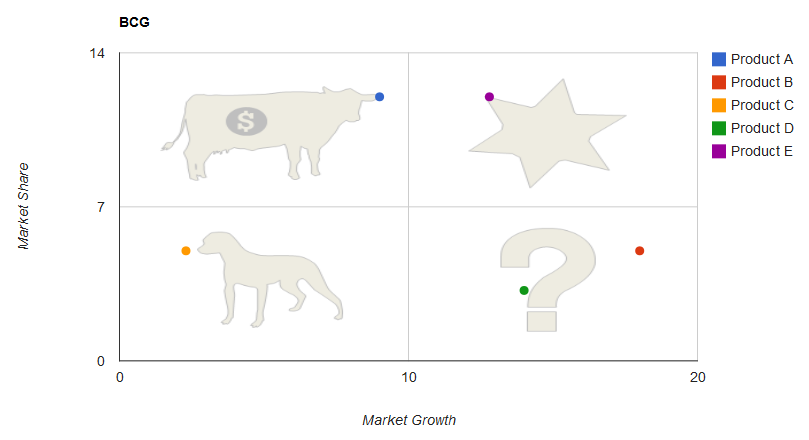

The resultant portfolio analysis can then be roughly divided into 4 quadrants. This is shown in the chart to the right.

Each of the four quadrants suggests a different strategic approach. For example:

- Stars: continue to invest for growth.

- Cash Cows: drive efficiencies.

- Question Marks: decide to invest or exit.

- Dogs: exit.

For example, Cash Cows may more readily lend themselves to "Competitive" strategic thinking (see for example Porter's 5 Forces Analysis). On the other hand, Stars may lend themselves to more "Blue Ocean" strategic thinking (see for example The Strategy Canvas).

In addition, one could vary the size with which you plot each source of value to represent, say, profitability.

Critical success factors

Critical success factors:

- How you define the scope of each market (for measuring market share and growth) is key to the placement of each source of value.

- Don't ignore cross synergies, for example, taking into consideration sources of value which may serve as loss leaders.

- Don't ignore cyclical effects.

- When considering the allocation of costs across sources of value, remember that all costs are variable in the long term. That is, don't think that you need to keep an unprofitable product, channel etc. going just because it is absorbing some of your "fixed" costs.

For more complex businesses

For more complex businesses, you may need to cluster sources of value together. For example, you may cluster large numbers of products together by organisational divisions.

To calculate the market share of a cluster of products or services:

- add the total value of sales of all products and services in the cluster.

- add the total value of all of the markets in that cluster.

- calculate 1 as a percentage of 2.

To calculate the growth rate of a cluster of products or services:

- add the total value of sales of all products and services in the cluster for the prior period.

- add the total value of sales of all products and services in the cluster for the previous period.

- subtract the two and divide them by the first number (and multiply by 100 for a percentage).

- You may need to consider adjustments for products and services introduced or withdrawn during the time period under consideration.

Where to find the BCG Matrix

To create or find your BCG Matrix:

- Sign in to StratNavApp.com.

- Select the project you want to work with.

- Click on "Analysis" on the main menu.

- Click on "Portfolio" on the drop-down menu that opens up.

- Select "BCG Matrix" on the model selector on the page that follows.

From that page, you will be able to add/edit products/services and enter the market share and market growth rate inputs for each.

Once you've completed your BCG Matrix you can also:

- Download it as an image to paste into another document, presentation or email by clicking the "download image" button

- see to the right and Downloading Images from StratNavApp.com

- Print it to paper or a PDF

- Include it in a strategy plan or report - see Generating Strategy Reports from StratNavApp.com